Tracking cities’ financial distress

Folks in Orlando, Fla., worry more about finances than any other big city, while Washington, D.C. residents worry the least. That is among the findings of a national Consumer Distress Index compiled by CredAbility, an Atlanta-based consumer help agency.

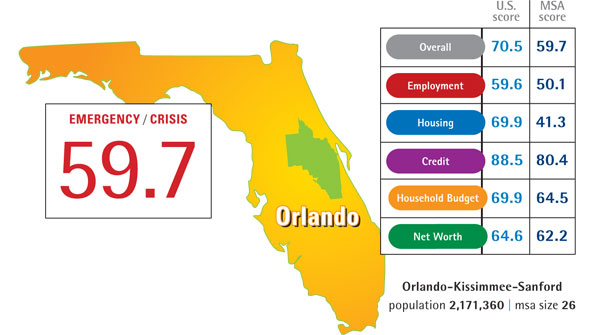

CredAbility assesses consumers’ financial worries through a 100-point index that includes measures of employment, housing, credit, household budgeting and net worth. A score below 70 is considered distressed.

Orlando ranks as the most financially stressed metro area. Its score of 59.7 earns the city an “Emergency/Crisis” rating. Washington, D.C., the least stressed metro area, clocks in at 76.8, which still only garners a “Weakening/At-risk” rating.

That shaky-at-best feeling is consistent throughout the distress ratings. The national score is a barely stable 70.5 for the third quarter, down from 71.3 in the second quarter. CredAbility cited as causes for the lower rating a rise in mortgage delinquency and an uptick in people working part-time who would rather be working full-time.

Still, in the glass-is-half-full category, folks seem to be worrying less than before. The current national score is almost four points higher than the third quarter a year ago.

Here’s a look at how some cities fare on the worry meter:

- Atlanta, 66.8

- Portland, Ore., 69.7

- Grand Rapids, Wyo., 70.2

- Austin, Texas, 75.4

- Las Vegas, 60.8

- New York, 70.8

- McAllen, Texas, 63.1

- Tampa, Fla., 60.7