Keating Report: mid-year 2016 forecast on government budgets and spending—Part 4

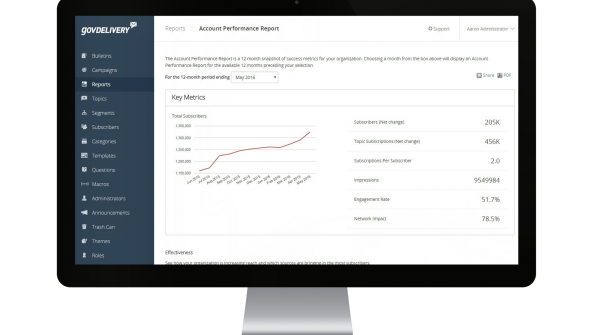

As we head toward the end of 2016, GPN reached out to vendors and experts to find out about technology acquisitions in government. Governments continue to embrace the cloud for their IT tasks, says Scott Burns, CEO and co-founder of GovDelivery. His firm offers a digital communications platform exclusively for government. The firm serves over 1,000 public sector organizations around the world.

“We are seeing an increase in adoption in cloud technologies as well as a focus on improving the citizen experience,” Burns says. “However, we are finding that agencies are continuing to have budget constraints and are dealing with short staffs as the retirement wave is beginning. Therefore, they are looking for a mix of technologies that has proven impact and is also easy-to-use and execute.”

There are changes afoot in municipal parking, says Matt Darst, senior vice president, mobility and parking solutions at Xerox. Parking meters will fade away, Darst tells GPN. “Due to the growth of app payments and alternative uses of metered spaces, strained city budgets will have no choice but to allocate less for meter purchases and support. Soon, the vehicles themselves will detect when they’re parked in a metered space, and the car will pay for parking. You’ll be charged only for the time you are parked, with your session ending as you drive away.”

Darst also predicts that tax credits and subsidized parking will boost ride-sharing among the poor. He says that it’s true that for the poor, owning a car can be an expensive burden. Owning a car, however, is viewed as a way out of poverty because vehicles provide critical access to schools and jobs. “To solve the last mile problem for those in need, government will likely promote car-sharing through tax credits and other incentives. Municipalities will seek to monetize their unused parking lots by giving car-sharing companies cheap access,” Darst predicts.

Sales of electronic security products in the government market, including federal, state, and local levels, is projected to rise 5.3 percent annually through 2019, predicts Freedonia Group report Number 3321. By 2019, demand in government for electronic security products will exceed $1.6 billion in product value. Institutional, educational facility and health care buys of those products are not included in the government market estimate. Freedonia Group is a Cleveland-based market research firm.

“Demand will primarily be driven by improvements to existing systems due to heightened concerns regarding physical security following a number of highly publicized incidents, including contractor Edward Snowden’s leak of thousands of classified documents in 2013,” Freedonia analysts state in the report.

“Demand will primarily be driven by improvements to existing systems due to heightened concerns regarding physical security following a number of highly publicized incidents, including contractor Edward Snowden’s leak of thousands of classified documents in 2013,” Freedonia analysts state in the report.

The analysts note the high degree of potential risk associated with security breaches in government facilities. Products such as cyber-hardened electronic security devices, access control systems, alarms, video surveillance and contraband detectors will be on governments’ shopping lists, the analysts predict.

_____________

To get connected and stay up-to-date with similar content from American City & County:

Like us on Facebook

Follow us on Twitter

Watch us on Youtube