The more you know

In the spring of 2013, NIGP’s strategic partner Spikes Cavell developed a Guide to Procurement Savings designed to show public sector procurement teams how they can use spend data to understand, change, and measure their procurement function. Previous issues of Government Procurement have featured articles on understanding the current spend situation, how to use data to find savings opportunities, and category analysis. Using the information from a category analysis, the procurement team can then go on to prepare for the contracting process.

In the spring of 2013, NIGP’s strategic partner Spikes Cavell developed a Guide to Procurement Savings designed to show public sector procurement teams how they can use spend data to understand, change, and measure their procurement function. Previous issues of Government Procurement have featured articles on understanding the current spend situation, how to use data to find savings opportunities, and category analysis. Using the information from a category analysis, the procurement team can then go on to prepare for the contracting process.

But we already know how to do an RFP and negotiate a contract, don’t we? This step is not about the intricacies and legalities of carrying out a competitive procurement process – these are generally well known and understood in the procurement community, and the specific required processes can vary greatly among organizations. If you have followed along from the previous article about building a category analysis, you have already identified categories of expenditure where renewing, creating, or renegotiating existing contracts would yield savings for your organization. Preparing for the contracting process in this context is about having a thorough understanding of the spend in the specific category where a contract is being let, understanding which internal and external stakeholders to engage with, and finding out whether there is a better way to put a contract in place than the traditional RFP or RFQ process.

Getting Down Into the Data

Some questions you may ask yourself when preparing for the contracting process: In the category which I’ve chosen to work on, how is the spend currently spread across suppliers that have been used in the last year? Do I have one primary grounds maintenance provider with a couple of secondary suppliers? Has this category only been loosely managed in the past, leading to a lot of one-off contracts and low-dollar fragmented spending? Is this a category in which we should focus on reining in maverick spend, or one in which we don’t even have a contract in place? Do we have a contract that is meeting our needs, or do we need to find someone new? Compiling basic contract and expenditure information together in one place where it can be sliced and diced by departments will be extremely helpful in answering these questions.

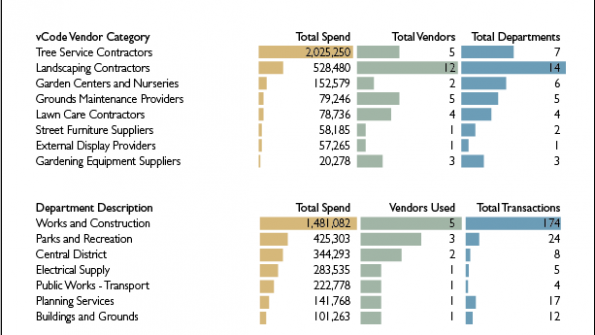

Another place to look for contracting opportunities is in internal collaboration. In a decentralized procurement environment, there may be contracts that were put in place by individual departments through correct competitive processes that might be perfectly suitable for adoption by other departments, rather than putting those departments through yet another competitive process. It is always worth bearing in mind the staff costs and time required to carry out a proper competitive process and weighing the potential savings of a brand new contract versus the costs of putting that contract in place. In the example shown in Figure 1, there are 14 departments utilizing 12 different landscaping contractors. While using an already-available contract may be a good idea, chances are if spend is fragmented in this way, there isn’t one particularly good contract in place.

Drilling into internal account codes might provide further information on the specific services purchased or prices paid, although this factor is dependent on the quality and completeness of coding in your finance system. Classifying the vendors according to their main business type helps to overcome account coding inconsistencies and inaccuracies.

Engaging with Stakeholders

It’s crucial to engage quickly with those in the organization who have bought goods or services in the recent past, identify what needs they have, and understand why they have a preference for a particular vendor in order to ensure that these considerations are included in the procurement specification and resulting contract. The more requirements covered and the more stakeholders engaged in the preparation phase of the contract, the better the likelihood the contract will be fully utilized to maximum advantage, and that maverick buying will be reduced after the contract has been signed. You may even be pleased to find that there is some category expertise in your departments.

Combined with your own procurement expertise, category knowledge will make it easier to procure the right goods or services that stakeholders need, at the best prices available and with favorable terms and conditions, all while following the procurement code of the organization. Looking at the example in Figure 2, while you might think that the Parks and Recreation department would spend the most with landscapers, tree service contractors, and garden centers, the chart shows that this is not actually the case. While you don’t want to ignore the smaller departments, Works and Construction spends nearly as much in the category as all the other departments combined; their experience may be invaluable.

The Current Contracting Situation

Last but not least, in preparing for the contracting process, it is helpful to understand what contracts are already in place. This can be accomplished through a simple excel spreadsheet listing contracts, vendors and expiration dates, or through a more complex contract management solution. Whichever you use, do you know what contracts you already have in place and when they are due to expire? Is there a short, medium or long term opportunity to consolidate spend on contracts with a smaller number of suppliers leading to a higher discount? Are there any recently expired contracts that have caused the organization to become noncompliant with its own procurement code? Is there a current contract with a local vendor on which a decision not to renew when renewal options are available would be politically difficult? Are there any opportunities to piggyback on collaborative contracts that might save considerable time, effort, and money?

You don’t have to answer all of the questions in this article to prepare for the contracting process, but the more you know, the more focused and effective your procurement efforts can be. Remember that, in many situations, your vendor knows more about the industry, market conditions, and pricing than you can possibly know. While you are responsible for 300 different categories of spend, the vendor only needs to know a few. Adequately preparing for the contracting process can help level this information advantage. There is information about your expenditure that your vendor can never know, and which may provide an edge in negotiations. The next article in this series will examine ways to monitor procurement savings and efficiency over time.

Jonathan White is Territory Director for Spikes Cavell, Inc., which equips decision makers in the public sector with the business intelligence, online tools and analytical insight to transform the way they procure goods and services. The Spikes Cavell Observatory is an online platform that facilitates delivery of spend and contract visibility quickly, affordably and with little effort on the agency’s or institution’s part.