Pension problems

Public pensions should offer local and state government employees a sense of security, with the knowledge their retirements are settled. But according to the Urban Institute, few public employees are feeling such peace.

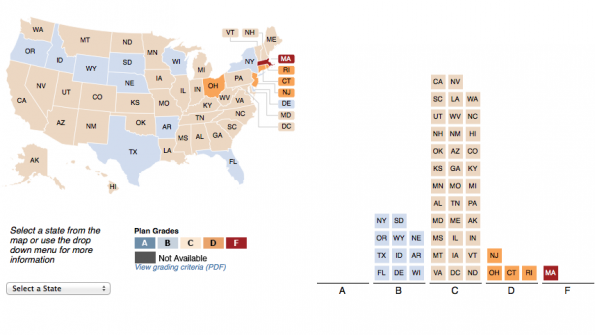

The institute analyzed 660 state-administered pension plans from across the country. The plans, logged in an interactive database, were graded on three criteria:

- how well they placed short- and long-term employees on the path to retirement security

- how well employee incentives help governments attract and retain a skillful workforce

- if governments are setting aside enough funds to finance the promised benefits.

The outlook for the nation’s 19 million state and local government workers was not bright. By the Urban Institute’s measures, only 1 percent of the 660 plans analyzed earned an “A,” while 11 percent earned an “F.”

Among the best, according to the Urban Institute, were:

- Texas plans covering general employees in counties, districts, and municipalities

- Nebraska plans covering general state and local employees Rhode Island plans for teachers and general state and municipal employees

- A Florida plan covering general state and local employees

- A California plan covering local police and firefighters

Among the worst were:

- A Massachusetts plan covering state police, teachers, and general state and local employees

- A New Jersey plan for state police, teachers, and general state and local employees

- A Colorado plan for veteran state troopers

- An Ohio plan covering teachers A Nevada plan covering local police and firefighters

Some other sobering findings of the report include:

- Only 19 percent of plans enable state and local government employees hired at age 25 to accumulate any employer-financed pension benefits within the first 10 years of employment.

- About a fifth of all plans changed their benefit rules between 2010 and 2013, with half increasing the time that employees must serve before getting anything out of their pension plans by three years or more.

- In 22 percent of all plans, age-25 hires must work more than 25 years before their future pension benefits are worth more than their plan contributions.

The Urban Institute suggests that cash-balance plans and other alternative benefit designs would enable state and local government employees to accumulate retirement savings gradually, rather than restricting benefit payouts to those with the longest tenures. These alternative structures, the institute says, would help attract younger employees who may frequently change jobs.

For more information or to see how your state or division matches up, take a look at Urban Institute’s interactive database.

_____________

To get connected and stay up-to-date with similar content from American City & County:

Like us on Facebook

Follow us on Twitter

Watch us on Youtube